Figure 7-8. Tell the Lifetime Planner about yourself.

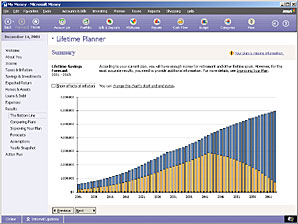

Figure 7-9. Review the results of your lifetime plan.

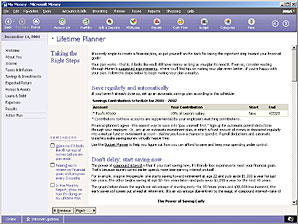

Figure 7-10. See how you can improve your lifetime plan.

When you create your lifetime plan, you enter information about yourself, your current finances, and your goals for the future. Your financial information includes your current income, your expenses, savings, and investments. Much of this information can come from information in your Money file. Your goals for the future may include events such as college tuition for your children, buying a sailboat, upgrading your home, retiring at 55, and so on.

Plan for contingencies. What if the stock market dips, tax rates change, or your elderly parents move in with you? Use the Financial Event Modeler to see how potential changes affect you and your plan. Money shows comparable graphs of your current plan to the proposed scenario. For more information, type ôFinancial Event Modelerö in the Ask Money box.